Dynasty GAAP Memo: The Chris Olave Theory

If you’ve read my work before, you know I write in the form of “accounting memos.” For anyone who has not been exposed, the format is very standard. Each memo will start with the “purpose.” Next, it will outline the applicable “guidance” or accounting literature utilized and supply background. Last will be the analysis and conclusion. The goal is to state the issue and quickly address it. My write-ups will follow this same logic.

To summarize, welcome to “Good at Analyzing Players” or “GAAP,”a play on “Generally Accepted Accounting Principles.”

Purpose

To evaluate how to capitalize on the cyclical nature of rookie draft season and introduce and market test the “Chris Olave Theory”.

Background

We are about to enter the best part of dynasty, the fabled off-season. This is where we will all get overly excited about rookies and spend hours and hours reading mock drafts, watching film, and deriving proprietary models to predict the best rookies. With those emotions and excitement comes opportunity for savvy owners to capitalize via bias. Bias is an irrational assumption or belief that affects the ability to decide based on facts and evidence. Investors (and dynasty managers) are as vulnerable as anyone to making decisions clouded by prejudices or biases.

I recognized this opportunity early last year and wanted to evaluate a new business concept or “dynasty theory”. In business, when a company wants to know how a new product will perform, there are multiple ways to gain information. They could perform various research surveys, perform pro-forma analysis of how a new business might work or prepare an over-engineered “business plan” to articulate why they will be successful. However, most entrepreneurs will tell you the best approach is to remove the overly complex hypotheticals and quickly follow the following steps:

- Derive a high-level concept or theory.

- Build a prototype.

- Move to market to test the concept as quickly as possible.

This memo will explore a dynasty theory that was derived and tested during the 2023 season.

Resources:

- Sleeper: Great interface for looking up historical statistics

- DLF Dynasty Rankings: Best dynasty rankings in the industry

- DLF Average Draft Position (“ADP”) Data: The best resource to gauge current player value. Based on real dynasty startups.

Analysis

When I was starting GAAP last off-season, I produced a high-level theory: how do I capitalize on the cyclical nature of rookie fever bias to gain value? Based on this concept, the “Chris Olave Theory” was born. Please see the assumptions of the underlying theory, the identified prototype, and the results of my market test below.

1. Theory: The Chris Olave Theory

This theory is predicated on the cyclical nature of rookie values. Every year, there are “phases” to the dynasty off-season. At the beginning, a rookie pick’s value soars as everyone gets excited. Then, the draft comes and picks do their best Icarus impression. As soon as the “it” factor of rookies starts to wear off, training camps start and everyone looks like the second coming of Jerry Rice.

It really is the most emotional time of year in dynasty. Everyone has their “guy” that they must draft and fall in love with because of X, Y, or Z. The season then begins and rookies do not produce right away and slowly depreciate until they break out and values start to recover and gain value. The graph below is an illustrative example of the ideal rookie season when considering player value and identifies potential buying opportunities in the phases noted above.

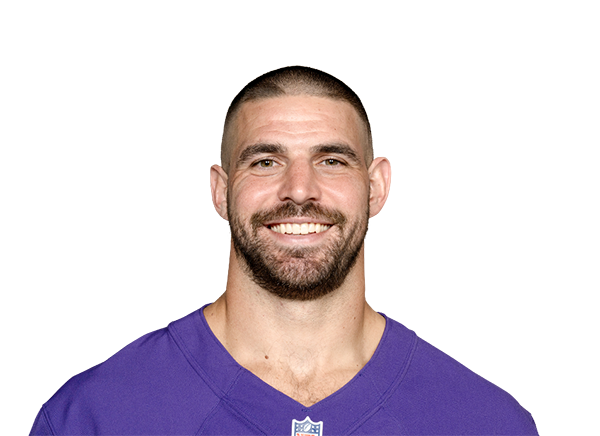

If you compare the timeline above to Chris Olave’s rookie season in ADP per DLF, it follows the same archetype. Thus, this is where my theory got its name.

I have attempted to identify this year’s (i.e., 2023) Olave based on the theory that I would buy at the lulls in value to try and pick value over the course of the season. I would purchase when value was low (post-draft lull or early season) with the intent to sell before the year was over (late season surge). I was looking for a highly drafted WR who I thought would produce in year one and be successful immediately in the NFL due to any combination of talent or opportunity. I chose to select a WR based on the positional value and longevity of young productive WRs. Utilizing the positional liquidity, I was confident that I would be able to obtain one and find suitors to execute the premise.

2. Identifying a Prototype

This was the riskiest component of the market study. It was predicted that I could identify a productive rookie WR. However, once I wrote about Jordan Addison last off-season, I knew I had found my “prototype.” The premise of the memo on Addison was that I would project Adam Theilen’s 107 targets from 2022 with a couple of other assumptions to calculate Addison’s rookie yardage total and do some sensitivity on it. I will not go through it completely, but you can read it here and the table below summarizes it:

In addition to Addison’s great opportunity in a pass-first offense, he and Olave had similar skill sets and profiles. They both had early breakout ages (85th percentile for Olave and 95th percentile for Addison), great college production, smaller frames, and were proven route runners and separators at the collegiate level.

I had said, “If he overachieves by 10% or 15%, Addison could be seen in a similar vein to Chris Olave and be considered a dynasty cornerstone that is nearly impossible to trade for.” If Kirk Cousins did not get injured, I believe that would have come to fruition.

3. Market Test

Once Addison was identified, I immediately went to the market to try and purchase him during the potential buying opportunities identified. Below are my purchase dates and prices and sell dates and prices of Addison in three leagues.

League A- 12 Team, PPR, SF, and TEP

Purchase – This trade occurred right before the early season lull phase of the timeline above on 8/31/2023.

In this trade, I sent:

- James Cook, RB BUF

- 2024 Mid 2nd (became 2.08)

- 2024 Early 2nd (became 2.03)

Then I received:

- Jordan Addison, WR MIN

- AJ Dillon, RB GB

I wanted to get a young WR who I liked on my roster. The cost of pre-breakout 2024 James Cook and a couple of seconds was enough to get me to bite.

Sell- This trade occurred after the fantasy season ended on 1/10/2024.

I sent:

- Jordan Addison, WR MIN

Then I received:

- DeVonta Smith, WR PHI

- 2024 Late 3rd (3.09)

I saw Devonta Smith as Jordan Addison’s ceiling from a production standpoint. They both have elite upside from a talent perspective and have All-Pro WRs in front of them on the depth chart (AJ Brown and Justin Jefferson). I was happy to cash in Addison for my perception of his ceiling and get something on top to accommodate for the three years age gap. Per DLF rankings, I moved from Addison at WR19 to Smith at WR11. I was happy with that.

Summary (Aggregating the Trades Above):

I sent:

- James Cook, RB BUF

- 2024 Mid 2nd (became 2.08)

- 2024 Early 2nd (became 2.03)

I received:

- DeVonta Smith, WR PHI

- 2024 Late 3rd (3.09)

- AJ Dillon, RB GB

Please see this input into the DLF Trade Analyzer below:

Verdict: Win; accumulated value.

League B- 12 Team, PPR (no SF or TEP)

Purchase – This trade occurred in the post-draft lull on 7/12/2023.

In this trade, I sent:

- DK Metcalf, WR SEA

- 2024 Late 2nd (became 2.10)

Then I received:

- Jordan Addison, WR MIN

- Elijah Moore, WR CLE

- 2024 Late 3rd (became 2.11)

I saw Metcalf and Addison in a similar tier and was a huge advocate for Elijah Moore. So I liked the idea of cashing in Metcalf for two younger WRs I believed in.

Sell- This trade occurred after Addison’s breakout during his late-season surge on 12/6/2023.

I sent:

- Jordan Addison, WR MIN

- Khalil Shakir, WR BUF

Then I received:

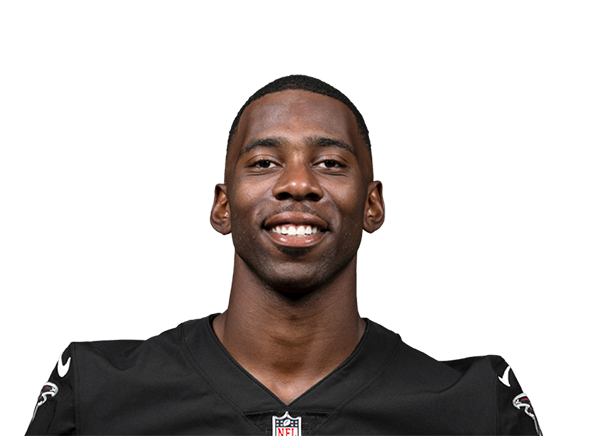

- Rashee Rice, WR KC

- 2024 2nd and 2024 Late Third (which eventually became Isiah Pacheco, RB KC, in another trade)

As a Kansas City Chiefs fan, I watched a lot of the Chiefs and Rice. After his first couple of breakout games, I was convinced that he would continue to produce for the rest of the season. The idea of getting swapping Addison for Rice-plus appealed to me. I actually wrote about Rice a few weeks ago if you want to get more of my thoughts. The fact that the picks eventually turned into young high-end RB2 in Pacheco was even better!

Summary (Aggregating the Trades Above):

I sent:

- DK Metcalf, WR SEA

- 2024 Late 2nd (became 2.10)

- Khalil Shakir, WR BUF

I received:

- Rashee Rice, WR KC

- Isiah Pacheco, RB KC

Please see this input into the DLF Trade Analyzer below:

Verdict: Per the DLF Trade Analyzer, I lost value. However, I would gladly do this again. Rice averaged 13.3 PPR points per game compared to Metcalf’s 14.1. When you consider in tandem that Rice didn’t have a full-time role in the KC offense until week 14, I’ll easily take Rice. In two months, Rice is ascending while Metcalf is trending downward. Getting Pacheco for a late second and Shakir is not too bad either.

League C- 10 Team, PPR, SF, and TEP

Purchase – This trade occurred during Addison’s breakout phase on 10/5/2024 (week five).

In this trade, I sent:

- Mark Andrews, TE BAL

- Christian Kirk, WR JAC

- Skyy Moore, WR KC

Then I received:

- Jordan Addison, WR MIN

- Courtland Sutton, WR DEN

- Marquise Brown, WR ARI

In this league, I had both Andrews and Travis Kelce, so the two were duplicative. I know I wanted to pivot off one for a young ascending WR (i.e., Addison). I was also happy to get Brown in the deal.

Sell- This deal has a lot, so bear with me. This trade was after Addison’s breakout on 12/11/2023.

I sent:

- Jordan Addison, WR MIN

- Travis Kelce, TE KC

- Courtland Sutton, WR DEN

- Adam Theilen, WR CAR

- 2024 Late 1st (1.08)

Then I received:

- Justin Jefferson, WR MIN

- Derrick Henry, RB TEN

- Chigoziem Okonkwo, TE TEN

The thought here was simple; get my first Justin Jefferson share. I also liked offloading a lot of the aging veterans in Thielen, Kelce, and Sutton as well.

Summary (Aggregating the Trades Above):

I sent:

- Mark Andrews, TE BAL

- Travis Kelce, TE KC

- Christian Kirk, WR JAC

- Skyy Moore, WR KC

- Courtland Sutton, WR DEN

- Adam Thielen, WR CAR

- 2024 Late 1st (1.08)

I received:

- Justin Jefferson, WR MIN

- Marquise Brown, WR ARI

- Derrick Henry, RB TEN

- Chig Okonkwo, TE TEN

Please see this input into the DLF Trade Analyzer below:

Verdict: Broke close to even. However, it is hard to tell based on the number of pieces involved. If you remove the noise, I moved two TE1s (Kelce and Andrews) and a flex WR3 (Kirk) for the WR1 overall (Jefferson), an RB1/2 rental (Henry), and a flex WR3 (Brown). I will take that.

Conclusion

In conclusion, I would call the “Chris Olave Theory” successful. From a value perspective, I either broke even or gained value in all three leagues. Overall, this will be a theory that I try to implement for years to come. The concept is a straightforward way to capitalize on the emotional bias of your league mates during the off-season if you time your buys and sells accordingly. Also, let this be a reminder to us all to not get emotionally involved in the rookie draft. Picks’ values are at their highest over the next couple of months. If you wait until the phases of the rookie lifecycle highlighted below, you will be able to purchase at a discount.

Do not shy away from moving rookies that have produced now. Their value is peaking right now and some league mates might overpay.

“Luck is earned by being in the game and not on the sidelines.” – Brad Sterling

- Dynasty GAAP Memo: Diontae Johnson - March 29, 2024

- Dynasty GAAP Memo: 2024 Free Agent Wide Receivers and the Christian Kirk Model - March 11, 2024

- Dynasty GAAP Memo: 2024 Free Agent Running Backs and the Christian Kirk Model - March 1, 2024