Cap Casualty Considerations

We are officially entering the most exciting part of the dynasty season. Managers are taking stock of this past season and all eyes are turning towards rookie prospects and the upcoming NFL draft.

While rookies are the shiny new additions to the dynasty world, much will change in the coming months through the off-season and free agency that will affect the fantasy landscape.

The first window of opportunity is presented when NFL teams cut players who have untenable contracts based on their cap space or disappointing production. This infuses unexpected talent into the free-agent pool and opens up new opportunities for players lower on the depth chart. This article will dive into some potential cap casualties and potential ways dynasty players can capitalize.

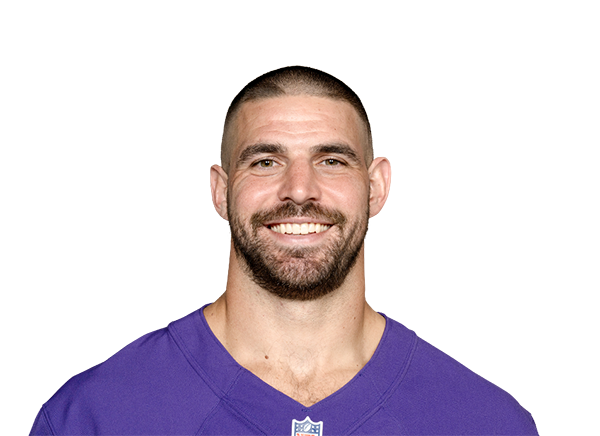

Sammy Watkins, WR KC

2020 Contract: $21M ($7M dead cap)

Watkins deserves to be front and center for this topic. He sits atop all WRs in 2020 salary ($21M), and his departure has numerous implications for the team’s other receivers. The Chiefs can save $14M if they choose to cut him this off-season, which is a reasonable expectation given his disappointing campaigns. He has missed eight games over the past two seasons because of injury, managing a total of 92 receptions on 145 targets for 1,192 yards and six touchdowns. It is worth noting that 16.6% (198) of these yards and 50% (three) of the touchdowns were from a single game in week one of 2019.

In a vacuum, this is reasonable production from a player in the WR2 role. He has been versatile, playing 50.1% of his snaps from the slot and receiving above-average grades (per Pro Football Focus) from each alignment. This decision must be considered in the context of value, though. His production does not come close to matching his salary and it could easily be argued that other receives could produce similar numbers for a fraction of the cost. Free agency and the draft will also have WRs who can fill his possession receiver role on a discounted salary.

Dynasty implications: Watkins is an immediate sell for any price that can recoup some value. Packaging him with other players may be the best option for getting value given how deflated his stock is coming out of this season. The other option is to wait until he signs elsewhere and sell the promise of a fresh start. I am highly skeptical this will work though. There is nowhere that presents a better opportunity than the Mahomes-led passing attack.

Watkins received a 19.7% target share this season, which opens up a substantial workload for a receiver to step up across from Tyreek Hill. Mecole Hardman will be the hot name. It is worth exploring his cost right now (chances are the owner is not about to sell low) since his perceived value will rise astronomically if (when) Watkins is cut. A sneakier pivot would be to target Demarcus Robinson or Byron Pringle.

Robinson is an unrestricted free agent, but the Chiefs may prioritize re-signing him if they move on from Watkins and he will not command a substantial contract on the open market. Pringle matches Watkins’ role better, evidenced by his increased snaps on weeks Watkins missed time (weeks 5-7). He is also under contract for one more season, providing additional security as a target over Robinson.

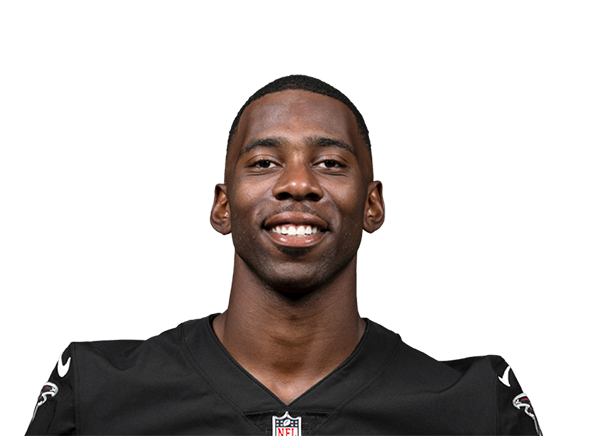

Devonta Freeman, RB ATL

2020 Contract: $9.5M ($6M dead cap)

Freeman signed a massive extension in 2017 coming off a career year in Kyle Shanahan’s offense. He has failed to live up to expectations. His five year, $41.25M finally has an “out” this off-season. The team will need to strongly consider moving on from their franchise injury-plagued back.

Freeman was 21st in rushing attempts in 2019 (184), but was 28th in rushing yards and 49th in rushing TDs in fourteen games. His receiving work (70 targets, 59 receptions, 410 yards, ten TDs) was helpful, but overall a disappointing campaign paired with another mid-season injury leaves his future in doubt. In addition, the Falcons are one of the most financially strapped teams in the league. They currently have only $10.5M projected cap space in 2020 coming off a 7-9 season. $6M in savings by designating him as a post-June 1st cut would go a long way to helping them with their dilemma.

The Falcons were 16th in offensive DVOA and 18th in offensive line ranks in 2019. The most notable stat, though, is the fact that the team led the league in pass percentage and attempts (67%, 734 attempts) by far. They ran the most plays while down fourteen points (by a large margin), necessitating them to pass far more often than other teams.

Dynasty implications: My prediction is that the Falcons 2020 leading rusher is not currently on the roster if they cut Freeman. Neither Ito Smith nor Brian Hill reliably produced when given an opportunity for the team to be confident with that tandem heading into 2020. It is doubtful the team pays in free agency given their cap situation. A day two or early day three draft pick is likely spent at the position.

Assuming Freeman has departed, any rookie with this landing spot will have a boost in value. We know that running back success is best predicted by opportunity. The Falcons were put in a position to get away from the running game and limit rushing attempts for their RBs. This can change quickly and a more balanced offensive approach should be expected for 2020. Dynasty managers can capitalize on this 2019 outlier season knowing that metrics will swing back next season.

Sell him before it is too late. This is an unusually deep free agent RB pool and a talented RB class (albeit depth has been lost with several players returning to school). It is unlikely he finds a landing spot where he will be featured, further sinking his value that has been declining steadily for years.

Data courtesy of Pro-Football-Reference.com, footballoutsiders.com, sharpfootballstats.com, and playerprofiler.com.

Thank you for reading. You can follow me @FF_TomB. I am always happy to answer questions and chat all things fantasy.

- The DLF Mailbag - February 7, 2020

- BMI Matters for Wide Receiver Prospects - January 29, 2020

- Cap Casualty Considerations - January 27, 2020