Risk Aversion, Player Valuation and You

It’s that time of year again. You’ve had your fill of turkey and have girded yourself for an entire month of holiday music every time you turn on the radio or go out shopping. You’re outraged (or not) by the Starbucks Christmas cup. Maybe you’re at least starting to think about buying presents. As the year wraps up, the news and social media will fill with talk of all the important trends of 2015.

And since we’re speaking of trends…

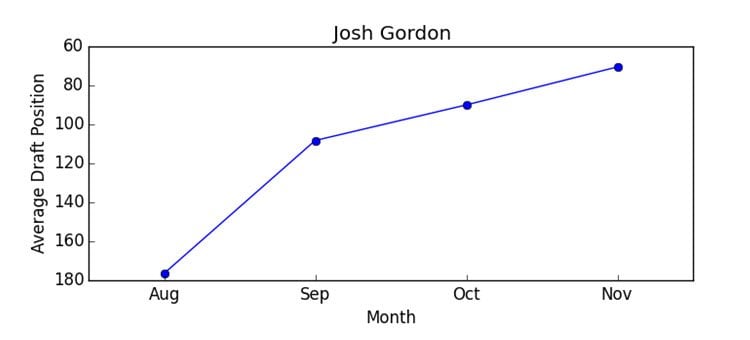

Josh Gordon’s ADP has risen 106 places since the start of the season? Well, we all know it’s not because of his stellar play on the field this year. A lot of this movement is likely explained by growing hype as his return to the field approaches, and your first instinct may be to scoff at it. It’s hard to see that much has changed about his situation over this time-span, after all. Before you get carried away though, I want to delve briefly into some simple theory to explain why this trend might be perfectly sensible.

[am4show have=’g1;’ guest_error=’sub_message’ user_error=’sub_message’ ]

Expected Value and Risk Tolerance

The first concept is fairly simple. Expected value is just the idea that the value of something multiplied by the probability of that something occurring is the “expected” value of it. Go ahead and imagine you have a ticket that gives you a 50% chance at $10, and a 50% chance at nothing. Its expected value, then, is:

0.5 * $10 = $5

Now compare this to two other tickets, one with a 100% chance at $5, and the other with a 10% chance at $50. Their expected values would be:

1.0 * $5 = $5

0.1 * $50 = $5

It’s fairly straight-forward to see that all three of them have the same expected value. Now I give you your pick of any one of the three, which one do you take?

Your answer depends on the concept of risk tolerance. To keep it simple, imagine three cases: risk averse, meaning you prefer to avoid risk all else equal, risk loving, meaning you seek out risk where possible, and risk neutral, where you’re fine either way. A risk-averse person is going to want the 100% chance at $5. A risk-loving person will want to swing for the fences and take a 10% chance at $50. A truly risk-neutral person will be entirely unable to make up their mind.

Now, how is this relevant to the case of Josh Gordon?

How this is Relevant to the Case of Josh Gordon

To anyone who has been following along, Gordon is quite clearly a risky asset. He’s demonstrated a ceiling that is through the roof (reference his 14 games of 2013), coupled with a floor that is… really low (reference everything not his 14 games of 2013). If you’re a risk-loving sort, that ceiling is incredibly attractive. On the other hand, if you’re risk averse you may be staying away from him unless he’s basically free, mainly because of the looming specter of his next infraction and ensuing suspension.

Of course real people aren’t only risk averse, loving or neutral. Rather, we fall on a continuum between them somewhere, and where we land almost certainly changes with the situation. A good fantasy football example of this is an end-of-the-bench stash. We call them “upside” players, but what we’re really referring to is that 10% chance of $50 from above. You stash this sort of player cheaply, hoping they achieve that wonderful upside (see Michael, Christine), but not really counting on it (at least I hope you weren’t). You don’t usually want to stash end-of-the-bench players with a risk averse mindset – that is, a player with a good probability of meeting their very low upside – even if your “expected value” of that safe player is the same as that of the high upside one.

This can make it difficult to trade risky players like Gordon. Even if you both have the exact same information and the exact same opinions on his probability of a successful return to stardom in 2016, your tolerance for risk may not line up.

So what about Gordon’s ADP since August? If you were more risk loving, you were probably higher on him all along and don’t find this trend terribly surprising. His upside already had you sold. The change would come from those leaning more toward risk aversion. Quite simply, every month that goes by where he isn’t in the news for another alcohol or drug related problem represents a decrease in his risk. If he can make it this long, the chances of him making it longer seem better. Every month past is one less that he has to keep himself in line while having nothing to do. Couple that with some reports that he’s been keeping himself in great shape and is looking forward to 2016, and maybe his risk has come down enough to bring you to the table. And that’s a perfectly rational reason for an ADP rise.

Conclusion

I don’t imagine anything here was earth-shattering for you. My goal was only to present a simple way of thinking about risk in player valuations. So the next time you’re having difficulty on a trade, or find yourself scoffing at an ADP rise or fall that you don’t agree with, try thinking of this framework and how it just might help explain some of it.

[/am4show]

- The Five Rules of Dynasty Trading - August 30, 2016

- Not So Fast There, Average - February 29, 2016

- Why Don’t Combine Metrics Predict Success? - January 21, 2016